How we ensured that seafood was allowed to cross the border

The client’s problem

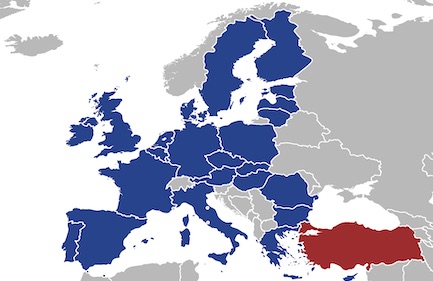

In this case, we are discussing a client who imports seafood from Turkey to the Netherlands, in order to sell the food to wholesalers throughout Europe. However, due to a conflict with their accountant, the company had a backlog with their Dutch tax filings. As a result, estimated tax assessments were imposed for Dutch VAT and corporate tax purposes.

Consequently, the trucks with seafood from Turkey were stopped at the Dutch border as the company had a serious tax liability, caused by the (unpaid) estimated tax assessments.

Our solution

In order to allow the trucks to move past the Dutch border, we needed to file objections against the estimated VAT and Dutch corporate income tax assessments. Besides that, we requested the tax collector for extension of the payment.

We motivated our objections by filing all VAT returns and Intra-Community transactions declaration (ICP declaration) that were overdue. Moreover, we were able to prepare and file the Dutch corporate income tax return as well. One by one, all estimated tax assessments and penalties were lowered and all Dutch VAT refunds were processed. And probably more important, the trucks were allowed to cross the Dutch border.

ICP declaration: a brief explanation

In addition to the Dutch VAT return, an entrepreneur also submits a declaration of intra-community supplies if goods or services are supplied (business-to-business) to customers in other EU countries. Here you enter all intra-Community deliveries and intra-community services, which you have supplied to customers who have to file VAT returns in other EU countries. You must also state the value of your own goods that you have brought to another EU country on the ICP report.

The current situation

Our client is now in compliance with his Dutch tax declarations again and he is meeting its monthly tax obligations. Therefore, the trucks can drive across the border without problems and the client can finally focus on his business (while we are taking care of his tax business).

During this assignment, we did not encounter any unforeseen difficulties. The completion of this issue resulted in a in an even better relationship with the client.

Note: due to the privacy of our clients, this case study provided by TGS lime tree does not include any names, numbers and other sensitive information of our clients, partners and other parties involved.