Demerger of a Dutch company

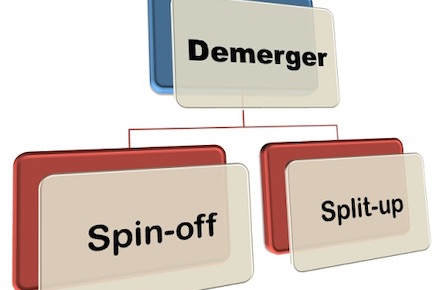

Another client of our firm is engaged in electronic services. It was the intention of client (a German owned BV-company) to separate its Dutch business in separate legal entities. For that reason we advised to make use of the demerger facility in Dutch tax law that makes it possible to transfer certain assets and liabilities exempt from corporate income tax to another group company. This way we create a holding company with two new operating companies below without tax being in the way.